Can I avoid ATM fees for withdrawing cash abroad?

The simple answer is yes. Like getting good deals on flights, hotels, tours, restaurants, etc. is possible, withdrawing cash abroad at ATMs can also be completely free or with very low fees. In fact, it can be the cheapest way to get cash in local currency, if you follow some smart, simple and easy steps.

Also read: Ultimate guide on how to travel on a budget in 2024

y Ultimate guide on how to save money for travelling in 2024.

Firstly, why should I worry about ATM fees in a foreign country?

In top tourist destinations, fees of a single cash withdrawal from the most expensive ATMs can equal to the price of 10 bottles of water, 4 cups of coffee, 1 pair of flip flops, 1 large pizza, or even 1 night in a hostel! So why spend unnecessary money on fees for withdrawing cash abroad when you can buy other useful things for the same price!

Top 9 ways to save on ATM fees and save money while travelling

1. Choose “Decline Conversion” while withdrawing cash abroad

Foreign ATMs can offer foreign card holders the option of “Accept Conversion” or “Decline Conversion” while withdrawing cash. This means:

- Accept Conversion: You want to withdraw money at exchange rate this ATM has set. The ATMs fixed rates are almost always much higher (5%-15% higher) as these incude “hidden” fees of the ATM.

- Decline Conversion: You want to withdraw the money at the exchange rate set by Visa, Mastercard, Amex or whichever logo you see on your card

So hit that Decline to save on fees. And remember, other ways of ATMs asking this are “With Conversion” or “Without Conversion”.

Read more on this here: Cash withdrawal abroad – What are ATM fees?

2. Choose to be charged in the local currency

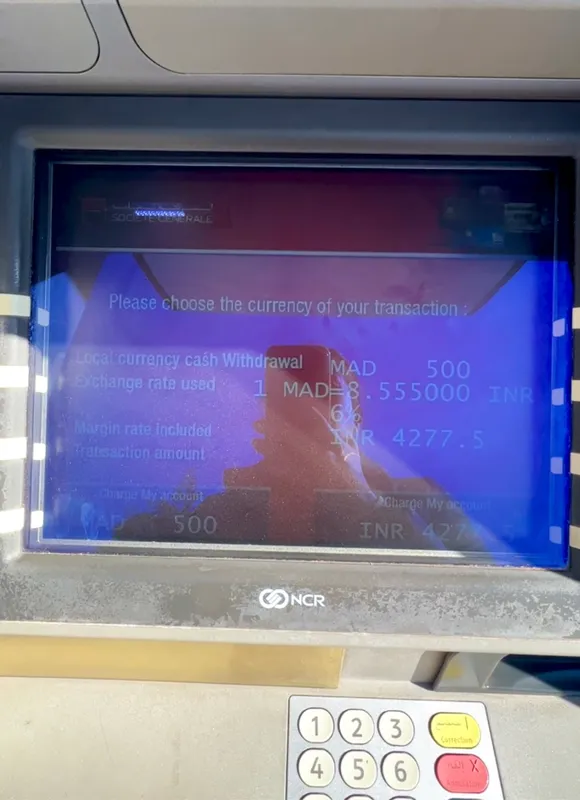

This is the same as Accept or Decline Conversion. Just an ATM’s way of tricking you to pay more fees. E.g., You see here that an Indian debit card holder, in Morocco, was asked if it should charge the account in Moroccan Dirham or in Indian Rupees. What it really means:

- Charge in Indian Rupee = Accept Conversion

- Charge in Moroccan Dirham = Decline Conversion

So, unless your bank’s fees are higher, choose to be charged in the local currency to save on fees i.e. Select the local currency when you’re travelling abroad.

3. Use ATM Fee Saver to find fee-free ATMs or low fee ATMs when withdrawing cash abroad

The ATM Fee Saver mobile app will help find ATMs in a foreign country with no fees or lowest fees. So use it and locate the nearest cheapest ATM abroad.

4. Try 2-3 ATMs before withdrawing cash abroad

If you can’t use the ATM Fee Saver app, and have little extra time or see many ATMs around you, it’s definitely worth trying 2-3 of them out before you actually withdraw cash in a foreign country. Because in most countries, ATMs tend to have different ATM fees. You might hit the jackpot!

5. Use your own bank’s foreign ATM if terms offer free withdrawals

Global banks tend to offer their customers fee-free ATM withdrawals abroad if their customers use the same bank’s ATM. E.g. like Citibank, HSBC, Deutsche Bank, etc. Check this information on the bank’s website to see if your card’s country branch is eligible.

Note: Even though, global ATM withdrawals can be free this way, don’t forget to check if you’ll still get charged other types of fees by your bank to use your card abroad, such as Currency Conversion fees.

6. Get fee-free, zero forex mark-up or low fee card for international travel

Do a quick comparison of banks and card companies in your country to see which one has lowest fees for international usage. E.g., In UK, normal debit card holders have different fees from different banks:

- Natwest: 2.75% of withdrawal as currency conversion fee

- Lloyds TSB: £1.50 fixed fee + 2.99% of withdrawal as currency conversion fee

- HSBC UK: 2% fixed fee + 2.75% of withdrawal as currency conversion fee

- Revolut: Free for upto 5 ATM withdrawals or £200 per month, then 2%

- Monzo: Free for upto £200 per month, then 3%

There are newer cards coming up often, so be sure to do enough research to find the best one for you for withdrawing cash abroad and order it before or during your international travel!

You might also like: Debit or credit card abroad? Which is better for withdrawing cash.

7. Use ATMs part of the Global ATM alliance or All Points Network when withdrawing cash abroad

Global ATM Alliance is a partnership among many banks in the world to remove ATM Fees for customers of all such banks. If you’re a customer in any of these banks you can withdraw cash from another bank in this partnership for free! Find if your bank is in the alliance here or ask your bank.

Similarly, All Points Network is an independent ATM network that has fee-free ATMs in US, UK, Mexico, Canada, Puerto Rico and Australia. Find out if your card is eligible for fee-free usage at these ATMs on All Points Network’s website.

8. Use bank ATMs, avoid independently operated ATMs to withdraw cash overseas

In some countries, you’ll see two types of ATM owners – banks or Independent ATM Operators. Bank ATMs are branded with their names. ATMs of Independent Operators are usually branded with words like “free cash”, “cash zone”, “euronet”, etc. Now unlike banks, Independent ATM operators earn only from the fees they charge for cash withdrawals. So while banks may or may not charge ATM fees to foreign card holders, Independent ATM operators will definitely charge you. They are known to trick foreign card holders into accepting high fees by using mysterious words and jargons on ATM screens. So do yourself a favour and avoid them!

Read more on this here: ATM fees abroad: All charges to use cards at ATMs abroad detailed.

9. Withdraw maximum amount in a single transaction

Typically ATMs have a per transaction limit i.e. a limit on the amount of money you can withdraw in 1 cash withdrawal. In case where the ATM Fee is a fixed fee – you pay this fee irrespective of whether you withdraw a small amount or the entire amount of the transaction limit. So if you withdraw the maximum amount that the ATM offers you in a single withdrawal, you can save on ATM Fees. But note that there are some ATMs which will charge you an ATM Fee depending on how much you withdraw, in which case, withdrawing higher amounts will not give you the benefit. However, always withdraw the amount you are comfortable with and not necessarily because an ATM gives you an option to withdraw a higher amount.

Not good with numbers? Use ATM Fee Saver mobile app’s calculator to find out ATM fees that you’re likely to have and make this decision.