You’re all set to enter the land of 1000+ languages, ride in tuk-tuks, eat mouth-watering spicy food, see temples, traffic, mountains, rivers, beaches and what not! To do all of this, you’ll need handy cash to get by in India as a foreigner. In this article, we tell you how to navigate ATMs in India, avoid fees and travel on a budget.

ATMs in India

India has one of the largest ATM networks in the world. There are 250,000+ ATMs in the country. All of them are run by the 50+ Indian banks and 8+ international banks operating in India.

Where can I find ATMs in India

You can find ATMs in nearly every town of the country. There are ATMs in big cities in India and at least 1-2 in small towns. Some of the common places to find them are:

- All big and medium sized airports – inside the airport and / or in the arrival area

- Bank branches

- High streets

- Local neighbourhoods

- Corporate buildings

- Food lanes

- Shopping malls

- Along the streets of the cities and towns

- Religious places

- Hill stations

- Tourist attractions

Cash or card in India

India’s official currency is the Indian Rupee (₹). India does not accept any other currency for its day-to-day transactions. So, if you’re travelling from the US, UK, Europe or any other country, you will likely need to use an ATM soon as you arrive.

India is a cash centric country for tourists and foreigners.

You will need cash for small ticket items like local taxis, public buses, local trains, street food, purchases from local shops and road-side markets. Small vendors and local businesses prefer cash payment also.

You can swipe your card at restaurants, hotels, hostels, online bus or train tickets, and ubers. Certain tourist attractions may also let you swipe your card for entrance tickets but its best to keep cash handy for these situations.

Recently, the government of introduced UPI for foreigners. UPI of Unified Payments Interface allows you to connect your foreign bank account to the UPI mobile app and simply scan a QR code to make cashless payments. Note – paying by QR code in India is used by locals extensively and can be an easy way to make payments.

At the time of writing this article:

– This is available to citizens of G20 countries.

– You can enroll for it at Mumbai, Delhi and Bengaluru airports on arrival.

Also read: 10 best free, unique travel apps for travelling in India.

Are ATMs 24x7

Yes. Typically, ATMs in India work 24 hours a day and 7 days a week. ATMs in bank branches are also usually open 24×7 and outside of banking hours as they are usually located outside the branch gate.

Do ATMs in India accept foreign debit and credit cards?

Simple answer is, yes. ATMs of all the popular Indian banks accept foreign debit and credit cards.

Some regional banks like City Union bank accept domestic cards only. But these ATMs are very few in the country, so you are not likely to see or use them anyway.

What types of foreign cards work?

ATMs usually accept cards with the logo Visa, Mastercard, Cirrus, JCB and UnionPay. You might find some ATMs that accept Diners, Amex, Discover but these are not common.

Please note that ATMs in India use chip-and-PIN cards.

Why do some foreign cards work and some don't at ATMs in India?

Like in any foreign country, it can happen in India that some foreign cards don’t work at some specific ATMs for various reasons. For e.g. at the time of writing this article:

- Cards from Revolut UK don’t work at ATMs of Bank of India but work at all other ATMs

- Cards from HSBC UK work at some ATMs of HDFC Bank but don’t work at other ATMs of the same bank

There are many reasons why foreign cards don’t work at ATMs in a foreign country. Reasons could be:

1. A particular card company is not verified by an ATM owner

2. ATM owners have put some temporary restrictions on some ATMs for security or other purposes

3. Some other reasons detailed in this article – Top 8 things to avoid while travelling abroad.

But it is likely that neither your bank nor the ATM will show you the reasons. So don’t worry if your card doesn’t work at one ATM in India. Try a different card or a different ATM.

Do India ATMs work like in any other country?

Yes. ATMs in India are modern, the machines look and feel the same as those in the US, UK, Europe, and Australia. So, you will have no trouble navigating through the ATM to withdraw your money easily.

How do I find an ATM in India?

ATMs in India will typically have a sign in English called “ATM” along with the bank name. E.g. SBI ATM (ATM of the State Bank of India), ICICI ATM (ATM of ICICI Bank), HDFC ATM (ATM of HDFC Bank), and so on. Just look for the “ATM” sign.

India’s ATM withdrawal limit

As on date, all Indian ATMs have a maximum withdrawal limit of Rs 10,000 per transaction (approx. $120, £100 or €110). In some cases, in remote areas, where ATMs might have less cash, you might be able to withdraw lesser than Rs 10,000 in one transaction. In that case, you will need to make multiple withdrawals or use other ATMs.

But these ATMs usually do not limit the number of transactions per day. The amount you can withdraw in a day from the ATM will depend on the limit set by your bank.

Banks with ATMs

The most popular ATMs in India are ATMs of domestic banks. These are:

- State Bank of India

- ICICI Bank

- HDFC Bank

- Axis Bank

- Kotak Mahindra Bank

- Bank of Baroda

- Punjab National Bank

There are many other banks with ATMs that also accept international debit and credit cards. Many ATMs are free and many charge high fees. Read on to know more.

Some international banks also have their ATMs in India, namely:

- HSBC

- Citibank

- Barclays

- Standard Chartered

If you have an account with these banks, then you might be able to get free withdrawals. However, these are very few in the country.

Global ATM Alliance India

Global ATM Alliance is a partnership among many banks in the world to allow its customers to withdraw cash from all partner banks abroad without any ATM fee. Many banks in the US, UK, Europe, Australia, and Latin America are part of the Global ATM Alliance, including Bank of America, Barclays, Deutsche Bank, and others.

In India – Deutsche Bank is part of the Global ATM Alliance.

Check if you’re bank is part of the Global ATM Alliance here and you might be able to avoid ATM fees in India using their ATMs. Note that Deutsche Bank has very few ATMs in India. But there are many other ATMs that do not charge any ATM fees.

Note – You might still pay foreign transaction or cash advance fees from your bank. To avoid this, find ideas from this article: Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

India ATMs and PINs type

Indian ATMs accept 4-digit PINs. If you have a 6 digit PIN, request your bank for a 4 digit PIN to be able to use your credit or debit card in India.

Languages of ATMs

ATMs in India by default are in English. You have the option to choose a language at the start of the transaction, but usually, the other options are regional languages of India such as Hindi. Do not expect to find ATMs that have language options such as Spanish, German, French, etc. Use Google Translate’s camera function if you need to translate ATM’s English language into your home language.

ATM fees in India

Typically, when you use an ATM abroad, there are 4 different types of fees that you might be charged:

1. Two fees from the ATM side – ATM Usage Fee and Currency Conversion Fee

2. Two fees from your bank side – Foreign Transaction Fee and Currency Conversion Fee (Forex Mark-up Fee).

Also read: ATM fees abroad: All charges to use cards at ATMs abroad detailed.

In India, ATM fees can be from ZERO fees to as high as Rs 335 per transaction of Rs 10,000. So the highest fee ATM charges you nearly $4 dollars for every $100! Why waste that money on fees? Take advantage of the ATMs that do not charge any fees in India.

Luckily, you will find these ATMs everywhere with the help of ATM Fee Saver mobile app!

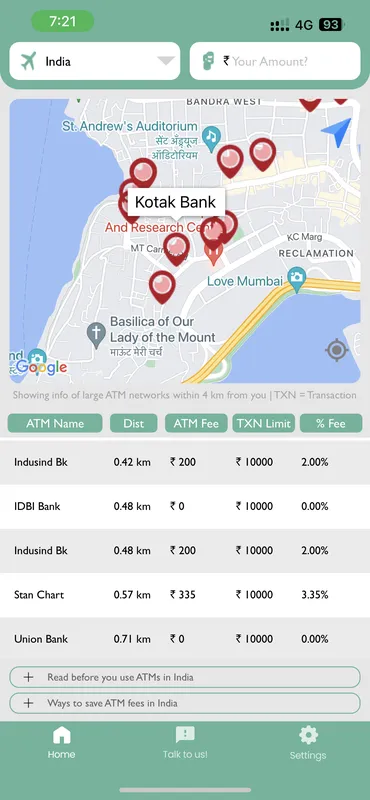

Use ATM Fee Saver to find the free ATMs in India

ATM Fee Saver is the first mobile app that helps you find fee-free and low-fee ATMs when you want to withdraw cash abroad.

You will find ATMs in India with ATM Fees, withdrawal limits on the app.

You can also use the app’s in-built calculator to calculate the fee for your desired cash withdrawal amount.

Once you decide an ATM, you can also use the navigator to find the best route to that ATM from your current location.

The app provides ATM info for nearly 40 countries in the world, including India.

Best ways to avoid high fees at ATMs in India

There are some simple ways to avoid ATM fees for foreign card holders in India. These are:

1. Use fee-free ATMs of domestic banks

2. Use ATM Fee Saver to find the fee-free ATMs

3. At the ATM, select “Decline Conversion” or choose “Without Conversion”

4. Open a multi-currency account with Indian Rupees loaded

…and there are many other ways too! Read more here in this entire article – Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

Are ATMs safe to use in India?

In general, yes. You will find many ATMs with cameras and security guards. Crime rates around ATMs are low. Pick-pocketing is more common.

There have been certain isolated cases of cameras being placed near the keypad of ATMs in India to find out your PIN. So cover the PIN pad when you use an ATM in India!

But whenever you use an ATM abroad, it is best to follow certain precautions. And this very much applies of India too! We have two entire articles dedicated to this topic. You can read them here:

Is it safe to carry cash when travelling around India?

It is safe to carry a reasonable amount of cash when travelling through India. In fact, you will likely need to keep some cash handy at all times for various purposes as we described earlier in the article.

Some safety tips for carrying cash while travelling in India are:

- Do not keep all your cash in one pocket or wallet

- Put some cash in a safety belt or fanny pack

- Do not flash loads of cash around

- Do not open your entire cash when you are paying for something

- Keep your wallets preferably in the front pockets

- Hold your purses, wallets and bags close and tight on crowded streets and in public trains and buses

FAQs

Are there Bitcoin ATMs in India?

No. India does not have bitcoin ATMs yet and most places do not accept bitcoins as a alternate form of payment. You might find some hotels, hostels that do so, but that is rare.

Are US, UK, Europe, Australia and other credit cards accepted in India?

In general, yes. International debit and credit cards from all major continents and countries are accepted in India at most ATMs (except some countries that are sanctioned by India from time to time.

Just ensure they are chip-and-PIN cards and have a 4-digit PIN.

Can I withdraw cash in India for free?

Yes, there are many ATMs in India that are free for foreign debit and credit card holders. Use ATM Fee Saver to find those free ATMs. Of course, there might be fees from your bank and also from the ATM if you “accept conversion” offered by that ATM. So hit “Decline Conversion” or “Without Conversion” when the ATM offers you that option.

Is there a Bank of America ATM in India?

No. There is no Bank of America ATM in India. But you can still withdraw cash from an ATM in India. Note that Bank of America charges a foreign transaction fee and a currency conversion fee.

Is there a Citibank ATM in India?

Citibank in India has been sold to Axis Bank. However, there is a 2 year transition period. So you will still find Citibank ATMs in India.

Is there a Barclays Bank ATM in India

There are only a handful of Barclays bank ATMs in all of India. And as you probably already know, India is BIG. So you are unlikely to find a Barclays Bank ATM when you need it.