You’re ready to arrive in the land of hills, beaches, deserts, parties, salsa, Spanish schools, and so much more! But to enjoy it all, you’ll likely need to carry cash at most times to get by in Colombia. In this article, we guide you on how to navigate ATMs in Colombia, avoid fees and travel on a budget.

ATMs in Colombia

Colombia is an interesting country when it comes to its network of ATMs. Where you’ll find ATMs, you’ll find a bunch of them around each other. And in some places, there are absolutely none. So you want to plan in advance.

Where can I find ATMs in Colombia

In Colombia, you will find many choices of ATMs in big cities especially in and around touristic destinations and areas. When it comes to small cities, you will find 1 or 2 options. But in many small towns, you may not find any ATMs, and even if you do, it may likely be far from where you are, or it can be out of cash. So withdraw in advance if you are going to travel remotely.

Some common places to find ATMs in Colombia are:

- Big airports

- Bank branches

- High streets

- Shopping malls

- Tourist attractions

- Market squares

Don’t always rely to find ATMs in Colombia in:

- Local neighbourhoods

- Small hill stations

- Towns

- Regional bus stops

- Religious places

How to identify an ATM in Colombia

ATMs in Colombia do not always have a sign called “ATM”. They are usually branded with the name of the bank. So you might have to peek a little bit when you see a bank name to find if its just a branch or there is an ATM there too.

Please note, ATMs in Colombia are not always marked on the maps apps that you might use. So rely cautiously. You can always ask a local directions for a “cajero” or “cajero automatico” nearby.

Use cash or card in Colombia

Colombia’s official currency is Colombian Pesos (COP or $) It has the same currency “symbol” as the US dollar i.e. “$” but it’s a different currency. Colombia doesn’t accept any other currency for its day-to-day transactions, except some places that might accept US Dollars. So you’ll most likely need to use an ATM soon as you arrive.

Colombia is a combination of cash and card centric country for tourists and foreigners.

Cash is preferred for small expenses such as taking local taxis, using public buses, buying street food, shopping at local stores, and making purchases at roadside markets. It’s important to note that small vendors, small tour operators and local businesses etc. often prefer cash payments as well.

Good news is that small vendors and local businesses tend to accept cards, but, be prepared to pay a small extra fee for this.

You can swipe your card at tours, hostels, hotels, restaurants, online bus or train tickets or metros, and some cab companies. Major tourist attractions also let you swipe your card for entrance tickets but its best to keep cash handy for these situations as machines are often not functional.

In many Spanish schools and hostels, there is usually an extra fee to swipe your card.

So you need to take a call if it is cheaper to withdraw money or swipe your card depending on the fees you incur from ATM withdrawals and card swipes.

Do Colombia ATMs work 24x7

Yes. Usually, ATMs in Colombia are operational 24 hours a day and 7 days a week. ATMs in bank branches are also usually open 24×7 as you find them at the branch entrance.

Do Colombia ATMs take foreign debit and credit cards?

Yes! Colombia ATMs are usually friendly to foreign debit and credit cards. ATMs of all the major banks accept foreign debit and credit cards.

Some regional banks like Banco Popular, Banco Occidente, Banco AV Villas accept domestic cards only.

However, there are two catches here:

- Firstly, different ATMs accept cards from different foreign banks and card companies. E.g. Davivienda accepts all cards from Europe and UK but doesn’t seem to accept some cards from Colombia. Same with Bancolombia and Caja Social

- Secondly, a foreign card may work at one ATM of a bank but may not work at another ATM of the same bank! E.g. Your same card may work at one Banco de Bogota ATM, but may not work at another ATM of Banco de Bogota.

There are many reasons for this such as:

1. Your card company is not approved by ATM owner

2. ATM owner temporarily restricted an ATM from using a foreign card

3. You can find more reasons detailed in this article – Top 8 things to avoid while travelling abroad.

But your bank or the ATM will not always display the reason.

So don’t worry if your card doesn’t work at one ATM in Colombia. Try at another ATM of the same bank if that’s the cheapest one. If you still don’t have luck at 3-4 ATMs of the same bank, then you can be pretty sure your card won’t work at any ATM of that bank. In that case, try a different card or a different ATM altogether.

Also read: Debit or credit card abroad? Which is better for withdrawing cash.

What types of foreign cards work at ATMs in Colombia

ATMs in Colombia commonly accept cards with the logo Visa, Mastercard, Cirrus, Plus. You might find some ATMs that accept JCB and UnionPay, Diners, Amex, Discover but these are not common.

Colombia ATMs do not always show the accepted card types on the stickers on the ATM or on the ATM screen. So you might have to try the card at the ATM and find out.

Please note that ATMs in Colombia use chip-and-PIN cards.

Are Colombia ATMs similar to other countries?

Yes. ATMs in Colombia are equipped with modern technology and the ATM machines look and feel the same as those in the US, UK, Europe, and Australia. So, you will have no trouble navigating through the ATMs to withdraw your money easily.

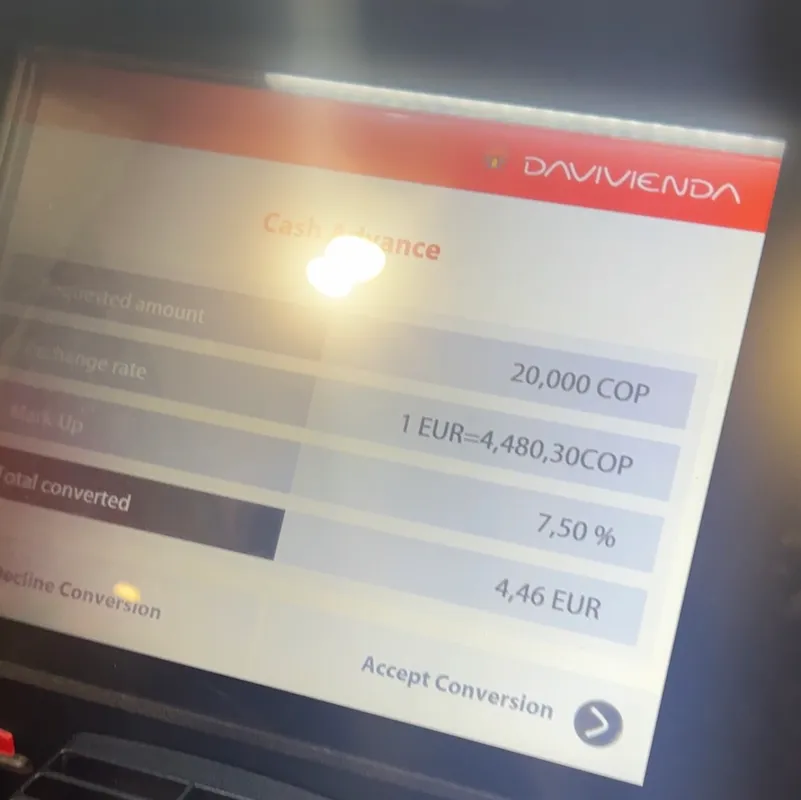

Also, when ATMs in Colombia offer you the option of currency conversion, it will generally use terms like “With Conversion” / “Accept Conversion” or “Without Conversion / “Decline Conversion”. It is usually better to choose “Without Conversion” or “Decline Conversion”.

Find out more why in this article – Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

Withdrawal limits of ATMs in Colombia

As on date, ATMs in Colombia has different maximum withdrawal limits per transaction. The highest withdrawal limits of different ATMs range between 300,000 Pesos to 2 million Pesos.

The interesting part is that ATMs of the same bank in Colombia tend to have different withdrawal limits depending on the location of the ATM. E.g.:

- In some locations, Davivienda offers withdrawal limit of 2 million Pesos per transaction and in others, only 400,000 Pesos

- Servibanca advertises on its ATMs that foreign card holders can withdraw up to 2 million Pesos in 1 transaction but some of its ATMs allow only up to 1 million Pesos.

Good news is that ATMs in Colombia do not limit the number of transactions per day. So if you need more money, you can make multiple withdrawals.

Names of popular ATMs

The popular ATMs in Colombia are ATMs of Colombian banks and some banks from neighbouring Latin American countries. These are:

- Bancolombia

- Banco de Bogota

- Davivienda

- Servibanca

- Scotiabank Colpatria

- Caja Social

Other international banks also have their ATMs in Colombia, namely:

- BBVA

- Citibank

- Itau

If you have an account with these banks, then you might be able to get free withdrawals. But except for BBVA, Citibank and Itau only have a handful of ATMs in Colombia.

Global ATM Alliance in Colombia

Global ATM Alliance is a group of local and international banks that have partnered so their customers can withdraw money from all partner banks for free. Many banks from different countries are part of this alliance, such as Bank of America, Barclays, and Deutsche Bank.

In Colombia, Scotiabank Colpatria is a member of the Global ATM Alliance.

Check with your bank if it is part of the alliance or you can check here. This might help avoiding ATM fees in Colombia.

But note that you may still pay your own bank’s other fees like foreign transaction fees or cash advance fees. To avoid these fees, you can find some helpful tips in our article here – Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

PIN type in ATMs and card machines in Colombia

Colombia ATMs accept 4-digit PINs as well as 6-digit PINs. If the ATM specifically shows you a 6-digit PIN box and you only have a 4-digit PIN, just enter it, leave the last 2 blank and continue with your transaction.

When you swipe your card in Colombia, contactless payments don’t require a PIN for small transactions. Large amount contactless transactions can require a PIN. If you need to insert your card in the machine, it is likely going to ask you a PIN (known in Spanish as “Clave”).

Languages of ATMs

ATMs in Colombia by default are in Spanish. But don’t worry if you dont know Spanish. Usually at the start of the transaction, you will have the option to choose a language – Spanish or English. As a back-up, you can use Google Translate’s camera function if you need to translate ATM’s English language into your home language.

ATM fees in Colombia

Typically, when you use an ATM abroad, there are 4 different types of fees that you might be charged:

1. The ATM’s two fees – ATM Usage Fee and Currency Conversion Fee

2. Your bank’s two fees – Foreign Transaction Fee and Currency Conversion Fee (Forex Mark-up Fee).

In Colombia, ATM fees can be from zero fees to as high as 26,000 COP. Depending on the withdrawal limit, you can land up paying as high as 10% of your withdrawal amount in ATM fees! Why waste that money on fees? Take advantage of the ATMs that do not charge any fees in Colombia. Or at least use an ATM that charges you 1-2% fees instead of paying 10%!

You can find such ATMs with the help of ATM Fee Saver mobile app!

Find free ATMs in Colombia with ATM Fee Saver

ATM Fee Saver is a mobile app that provides you with ATM fees and withdrawal limits of all major ATMs in Colombia.

The app’s in-built calculator helps you calculate the ATM fee for your desired cash withdrawal amount.

The app’s navigator helps you find the best route to your chosen ATM.

The app provides ATM info for nearly 40 countries in the world, including Colombia.

Ways to avoid high fees at ATMs in Colombia

In Colombia, foreign card holders can avoid ATM fees by following a few simple methods. These include:

1. Using some of the fee-free ATMs available in the country

2. Using the ATM Fee Saver mobile app to locate fee-free ATMs or low-fee ATMs

3. Choosing “Decline Conversion” or “Without Conversion” at the ATM

4. If possible, getting fee-free cards from home

…Additionally, many other ways exist to achieve the same goal. To gain further insights, we have written a comprehensive article titled – Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

Are ATMs safe to use in Colombia?

Safety on using ATMs in Colombia depend on a few factors:

- Location of the ATM

- Time of using the ATM

- People in and around the ATM

There have been many cases of being mugged for cash outside ATMs especially during night time, on empty streets and even in crowded places. Even though in general you are safe as long as you follow precautions, Colombia does have regular instances of tourists and locals being threatened with knives and guns for stealing valuables and money.

In order to follow precautions, follow guidelines given in these two articles:

Safe to carry cash while travelling in Colombia?

In general, no. It is not safe to carry a large amount of cash when travelling in Colombia. Of course, some cities and towns are safer than others, but in general, you should carry only the amount of cash you need for the day or for few hours. Since you’ll often need to have some cash readily available when travelling to Colombia, here are some tips to keep your cash safe:

- Avoid keeping all the cash in one pocket or wallet. Spread it out.

- Consider using a safety belt or fanny pack to store some cash.

- Avoid showing off large amounts of cash in public.

- When making payments, avoid revealing all of your cash at once.

- Keep your wallets in the front pockets of your pants, if possible.

- In crowded areas, like busy streets or public transportation, hold your purses, wallets, and bags tightly and close to you.

FAQs

Are there Bitcoin ATMs in Colombia?

Yes, there are bitcoin ATMs in Colombia but these are only in big cities with most of them in Bogota. Do not expect to find them everywhere. If you need to use it, track one on maps and plan in advance. Also do not expect a lot of hotels, hostels or tours that accept bitcoin as a currency.

Are US, UK, Europe, Australia and other credit cards accepted in Colombia?

International debit and credit cards from all major continents and countries are accepted at ATMs in Colombia. However, not all cards from all countries work at the same ATMs. So you might find that a friend’s card from Europe works at one ATM but another card from India doesn’t work at the same ATM.

Just ensure they are chip-and-PIN cards.

Can I withdraw cash in Colombia fee-free?

As on date, only 2 ATMs in Colombia are fee-free for certain types of cards. Use ATM Fee Saver mobile app to find such ATMs. All other ATMs charge some form of fees. But these vary significantly, so you want to find the lowest-fee ATM.

Further, ATM can also charge you extra fees if you “accept conversion” offered by that ATM. So always select “Decline Conversion” or “Without Conversion”.

Of course, you bank might also charge you fees for using your card abroad in Colombia. Therefore, getting a fee-free or low-fee card from home is ideal when you travel to Colombia.

Any Bank of America ATMs in Colombia?

No, there are no Bank of America ATMs in Colombia. But you can use a Bank of America card to withdraw cash at a local ATM of a Colombian Bank.

Any Citibank ATMs in Colombia?

As on date, Citibank has only 1-2 ATMs in Colombia. So don’t rely on finding them everywhere, when you might need it.

Any Barclays Bank ATMs in Colombia?

No, there is no Barclays bank ATM in Colombia. But you can use a Barclays bank card at local ATMs of a Colombian bank.