We’ve all probably experienced one of many moods of foreign ATMs – Hungry (ATM eats your card), Moody (Declines the transaction), Mystery (Doesn’t give an error but no cash either). And the funnier part is – the ATM won’t always tell you why its in that mood! Worry not, in this article, we break down the reasons why possibly your card doesn’t work abroad at ATMs and what you can do about it.

7 reasons why your card doesn't work abroad at ATMs

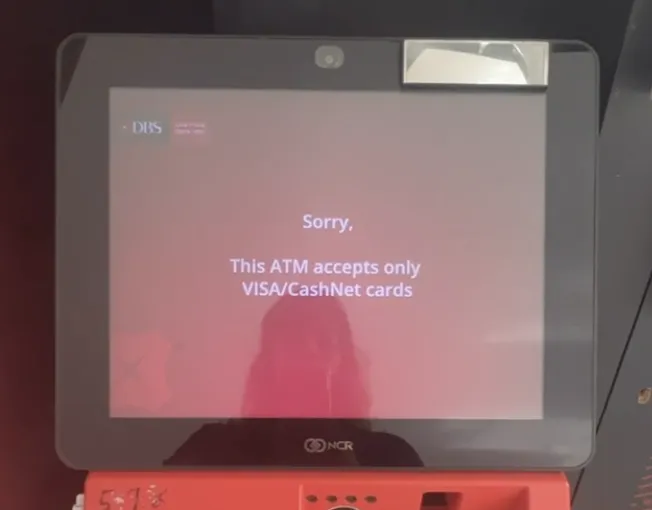

1. ATM doesn’t accept your type of card

2. ATM doesn’t accept international cards

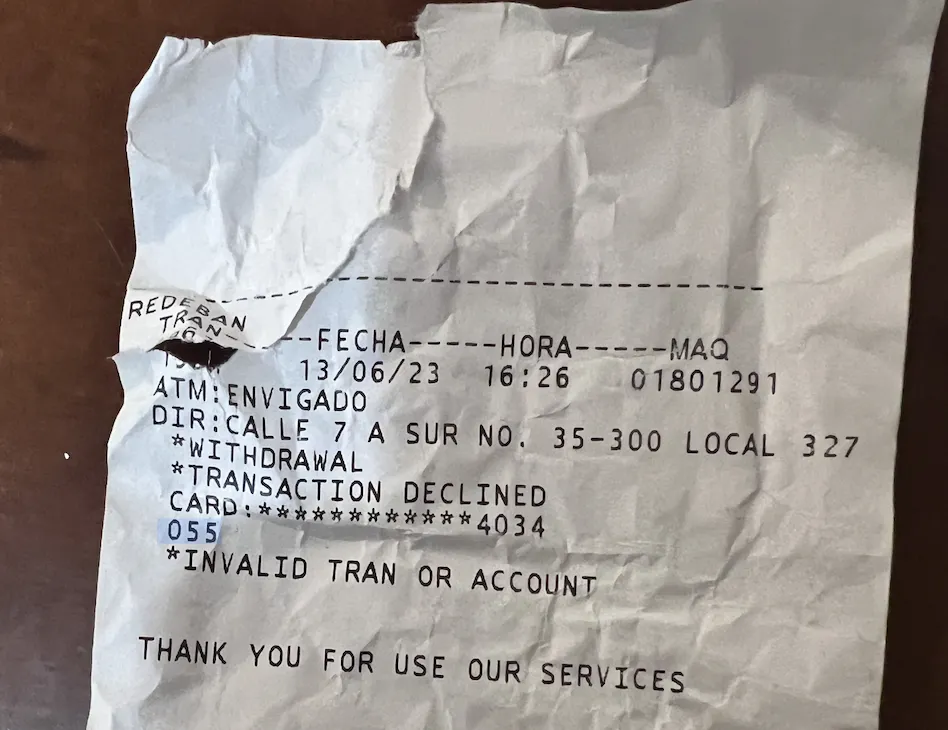

Many ATMs don’t have the ability to process transactions of cards that are issued out of their own country i.e. foreign or international cards. The ATMs don’t typically mention this on the ATM machine. So there’s no real way of you finding this out why your card doesn’t work abroad at that ATM. You will likely be greeted with a “transaction was declined” or “transaction could not be processed” error.

ATM Fee Saver mobile app will help identify such ATMs in 35+ foreign countries that accept international cards along with their fees and withdrawal limits for foreign cards holders.

3. ATM doesn’t have enough cash

Simple but so confusing, isn’t it. The ATM has simply run out of money or it doesn’t have enough cash for the amount you’re trying to withdraw. Unfortunately, many ATMs don’t tell you this so you land up scratching your head as why your card doesn’t work at the ATM abroad!

4. There is a withdrawal limit or limit on number of transactions

ATMs in many countries limit the number of transactions you can carry out in 1 day or the total amount you can withdraw in 1 day for foreign card holders. If you withdrew cash a few times and suddenly the ATM stops working for you, this is the likely reason why your card stopped working at that ATM.

The situation can also happen from your account’s side. If your account doesn’t have enough money and you’re still trying to withdraw funds, the foreign ATM will decline your transaction.

Also read: Ultimate guide on how to travel on a budget in 2024.

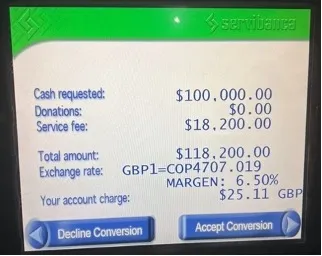

5. ATM gives cash only if you “Accept Conversion”

This is a sneaky strategy from ATMs. Typically, ATMs will give you an option of “Accept Conversion” or “Decline Conversion”. If you Decline Conversion, the ATM doesn’t earn extra fees from you. So it may be programmed to not give you the cash in this case and possibly decline the transaction.

6. ATM has these technical glitchs during your transaction

Technical glitch is such a commonly used term for foreign ATMs. Let’s break down some of the possible technical glitches that could lead to your card not working abroad at ATMs:

- Network or communication Issues – The ATM’s server system is unable to communicate or connect with your bank’s server at the time you’re trying to carry out your withdrawal

- The ATM itself has a technical fault so while it may seem like its working on the front, from the back-end, its systems are not operational

- Electricity issues could be another one considered to be “technical glitch” or “technical fault”

7. ATM or your bank detect fraud and temporarily stop your card from being used at the ATM

Some common things that lead to this are:

- Entering the wrong PIN over 3 times

- Carrying out many transactions very quickly

- Two or more transactions were carried out in 2 countries in a short time, which leads the bank to think its not physically possible for you to be at 2 locations far away around the same time and somebody might be misusing your account

12 things to do if your card doesn't work abroad at an ATM

If your card doesn’t work abroad at an ATM, here are the 12 things you can do to resolve the issue yourself:

1. Carry an “international” card when you travel abroad

This simply means that before you go abroad, confirm with your bank that your card can indeed be used in a foreign country. If not, get a card that does.

Also read: Debit or Credit Card: Which is better for withdrawing cash abroad?

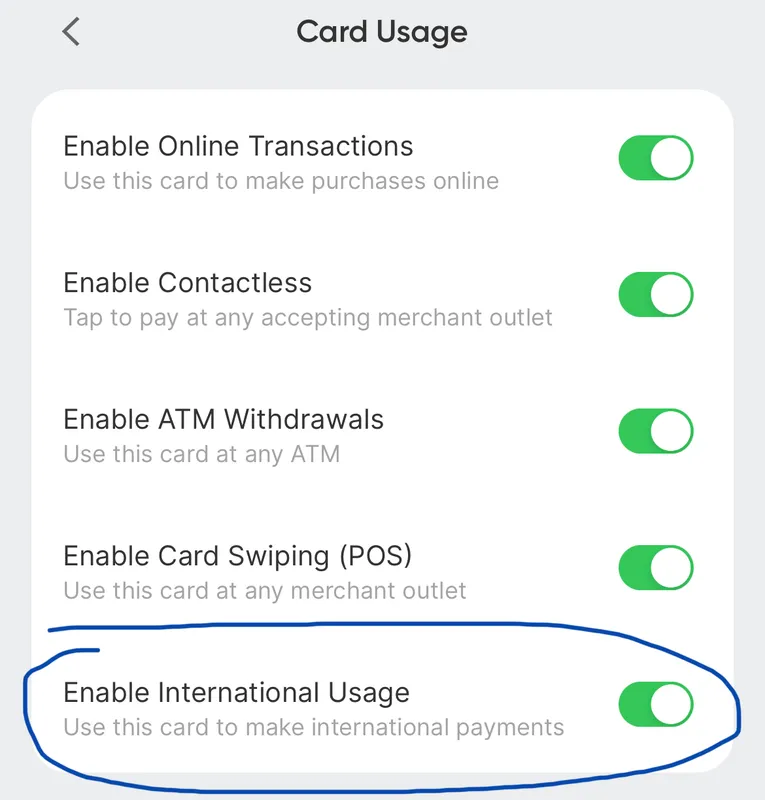

2. Switch on “international transactions” on your card

This is especially an issue if you are using an old card. Such cards are not automatically “Active” for use in foreign countries. To activate it for international transactions, you either need to call your bank or switch them “on” from the bank’s mobile app or website login.

3. Use a card that is not damaged or expired

It’s always a good idea to check if the two main parts of your card are not damaged:

- Too many scratches on the black strip at the back of your card

- A broken chip on your card

If so, you’re better off ordering a new card before you travel overseas. Note – Many banks may not deliver at unknown addresses abroad.

4. Enter only the correct PIN at the ATM

A simple but commonly occurring issue. Especially if you carry multiple cards, you can forget your PINs. At most ATMs abroad, if you enter the wrong PIN more than 3 times, either the ATM abroad or your bank is likely to decline the transaction and your card will not work at the ATM. Not only that, as a mechanism to prevent potential fraud, it might also not allow you to use the card at any ATM for a 24-hour or more holding period. In some cases, your bank may block your card until you call them and unblock it.

5. Use ATMs that accept your card type

At a foreign ATM, before you start a transaction, verify that the ATM accepts your type of card. Check the logo on your card – Visa, Master, etc. and look for a sticker on the ATM machine that shows these logos also. If the logos match, then the ATM accepts your type of card. At some ATMs, instead of the sticker, they display this information on the ATM screen. And if you’re unlucky, some ATM machines don’t display this information at all – either on a sticker or the screen. They might either tell you this after declining the transaction or give no notification at all!

Also read: Top 10 things to bring when travelling abroad.

6. Use ATMs that accept international cards

This is not easy as most ATMs do not specifically mention if they accept cards issued in other countries. A handful of ATMs specifically mention this either on top of the ATM or on the ATM screen. If not, there is not much you can do except trying your luck at another ATM.

7. Unblock your card if it has been temporarily blocked by your bank detecting any fraud

Banks may detect suspicious or possible fraud activities on your card for many reasons – entered wrong PIN many times, card was used in 2 or more countries within a short time period of each other, carried out many transactions quickly, and many other reasons. This is done for the safety of your account, but it can be an inconvenience when you’re abroad. You can call your bank to check if this is an issue and remove any blocks on your card.

8. Have enough money or credit limit in your bank account or credit card

If you don’t have enough money in your bank account and you’re trying to use the card at a foreign ATM, the ATM will decline your transaction. Also, some banks charge penalty fees for trying to withdraw cash when you don’t have enough cash in your account. So, it’s always a good idea to cross-check this or transferring money to the card account before using a foreign ATM.

9. Don’t exceed your transaction or withdrawal limits and spread out your withdrawals

In general, its a good idea to be aware of the withdrawal limits on your card. This can be per day, per week or per month.

Foreign ATMs may also give you an alert like “You have exceeded maximum withdrawal limit for the day”.

10. Try other options

When you’ve verified and none of the above mysteries are solved and you’re still not able to use the card at an ATM abroad, try these:

- Wait 5-10 mins before you use the same ATM with the same card

- Use another card at the same ATM – ideally with a different logo. E.g. If you used a Visa card before, try a Mastercard

- Use another ATM of the same bank – Just because one ATM of a bank doesn’t work with your card, doesn’t mean another ATM of the same bank won’t. Especially if its a fee-free ATM, try using a few other ATMs of the same bank before you conclude that this fee-free ATM is just not for you

- Use an ATM of a different bank

11. Accept conversion, only in emergency situations

If you find that the ATM gives you cash only if you accept conversion and you need the cash so badly that you just cannot wait, then use the ATM with your card by accepting conversion. Note – Accepting Conversion means that the ATM will charge you high additional fees for the transaction.

Also read: ATM Fee Saver: All charges to use cards at ATMs abroad detailed.

12. Record the error code you see on the ATM

If a foreign ATM declines your transaction, it may give you an error code “500” or some such. This is either on the ATM screen or on the receipt. Save this and reach out to the ATM Bank or your Bank to find out the issue. It will easily help resolve the mystery of a foreign ATM not working with your card!

What to do if the ATM eats your card?

If a foreign ATM is so hungry that it swallows your card, then you can do the following to try and get your card back:

- Go inside the bank, show your proof and ask them to retrieve card (That’s why it’s always better to use an ATM in and around a bank branch, in a foreign country)

- Call the ATM bank and ask their procedure to retrieve card

- Last option – Call or write to your bank to get a new card possibly delivered overseas

You will find lots more tips in this related article: Lose card abroad? Top 8 tips to get it back & save it from misuse.