Planning an international trip or just got back and noticed unexpected charges on your bank statement? If you withdrew cash abroad, chances are you were hit with some form of ATM fees abroad – either by the ATM itself or your bank. In this guide, we explain that various kinds of fees you can face when using your debit or credit card to withdraw cash at an ATM in a foreign country and more importantly, how you can avoid them.

What are ATM related fees and why should I know about them?

Simply put, ATM related fees are fees that a foreign bank or an ATM charge you, the traveller, to use your debit or credit card in a foreign country i.e. in a different country from where your card was issued to you.

For e.g. You are from UK and you are travelling to Colombia. You have a debit card from your UK Bank where you have a bank account and you use it in Colombia, when you need local cash Colombian Pesos (COP or C$) for your spends. In this case, you can:

- Swipe your card directly at a restaurant or tour company, etc., or

- Exchange your home currency for Dong at a currency exchange centre, or

- Withdraw cash from an ATM of a local bank in Colombia like Davivienda, Servibanca, Banco de Bogota, Bancolombia, etc.

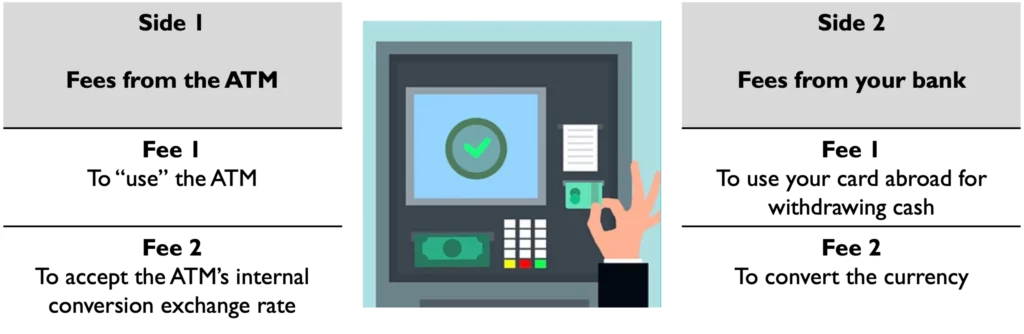

When you use your UK-bank issued debit card at the ATM in Colombia, you consider two sides of potential ATM related fees – fees from your UK Bank side and fees from the ATM side.

The sole reason why it’s important to know about these fees is so you can plan the best ways to get local cash in a foreign country and preparing for many ways in which you can avoid paying such fees and spend it on other fun experiences.

The four types of fees when you use an ATM abroad

The four types of ATM fees when you use your debit and credit card abroad are:

- Fees from your bank side: Foreign Transaction Fee and Currency Conversion Fee (Forex Mark-up Fee).

- Fees from the ATM side: ATM Usage Fee and Currency Conversion Fee.

Also read: Debit or credit card abroad? Which is better for withdrawing cash.

Let’s understand these better.

1. Your Bank’s side fees

A. Foreign Transaction fee

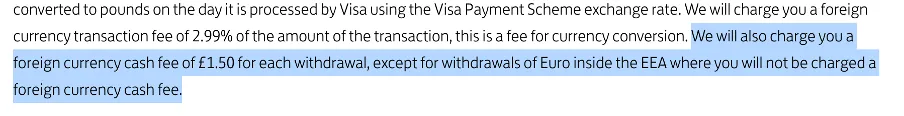

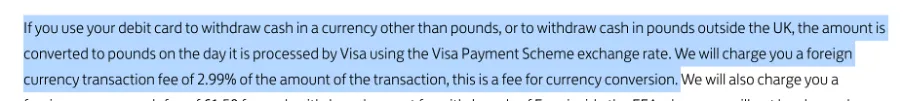

The Foreign Transaction Fee, also known is usually a fixed fee charged by your Bank to conduct an ATM withdrawal at a foreign ATM. This is also known as Foreign currency cash fee or Withdrawal Fee. E.g. a UK based bank charges a 1.5 pound fixed fee for an ATM withdrawal abroad.

So if you withdraw 100 and the foreign Transaction Fee is 1.50, then the total debit from your account will be 101.50.

B. Currency Conversion Fee (Forex mark-up fee)

When you withdraw cash from an ATM abroad, you are effectively exchanging your home currency for the local currency. Your Bank can therefore charge a “Currency Conversion Fee” to carry out this exchange i.e. a fee to convert the currency of your account money into the local currency in which you want cash. E.g., A UK bank charges 2.99% currency exchange fee.

So if you withdraw 100 and forex mark-up fee is 2.99% of the withdrawal amount, then the total debit from your account will be 100 + (100 x 2.99%) = 102.99.

2. ATM side’s fees

A. ATM Access Fee

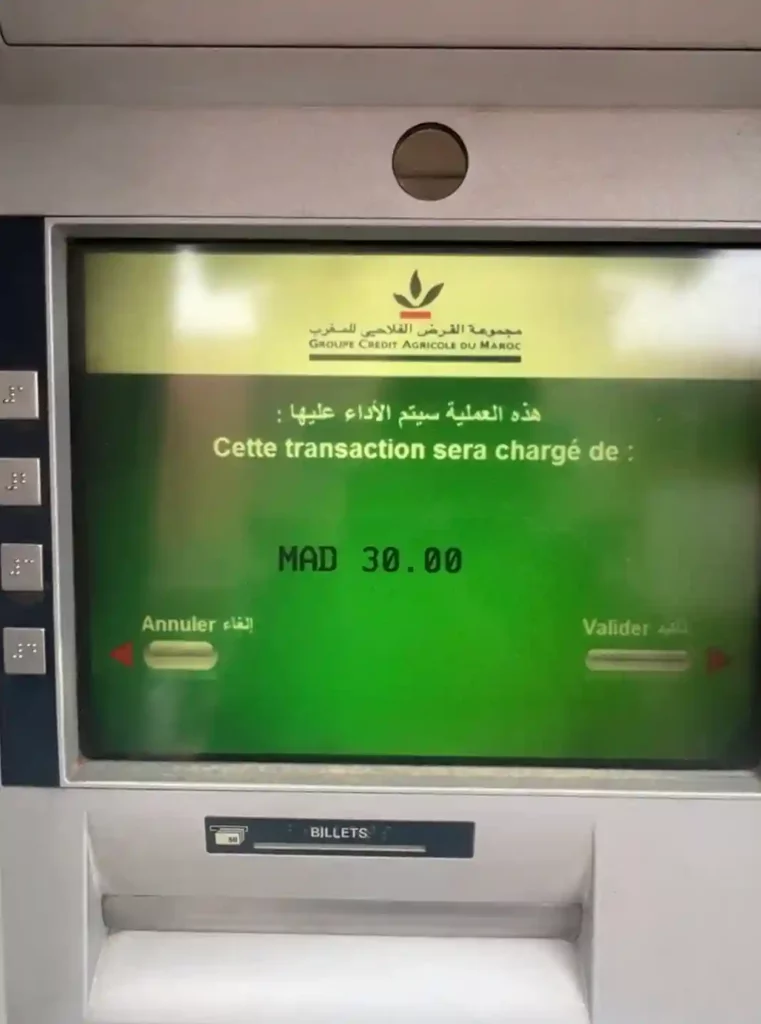

ATM Access Fee is typically a fixed fee charged by a local ATM to a foreign card holder to use the ATM’s withdrawal services. This is also known as an “ATM usage fee” or simply “ATM fee.” ATM owners collect this ATM Fee. The ATM owner is usually a local bank or an independent ATM operator.

So if you withdraw 100 and ATM Access Fee is 5, then the total debit from your account will be 100 + 5 = 105.

Also read: Why your card doesn’t work abroad at ATMs and what to do?

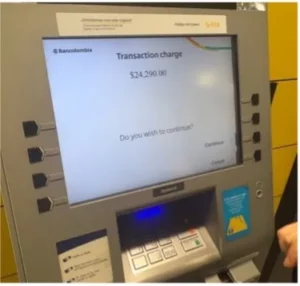

B. Dynamic Currency Conversion (DCC) fee

As you know, when you withdraw cash from an ATM abroad, you are effectively exchanging your home currency for the local currency. The ATM can offer you the option to carry out this exchange at the ATM’s fixed currency exchange rate and charge you an extra DCC fee. Dynamic Currency Conversion Fee is therefore the ATM’s fee to exchange the cash at the ATM’s fixed exchange rate.

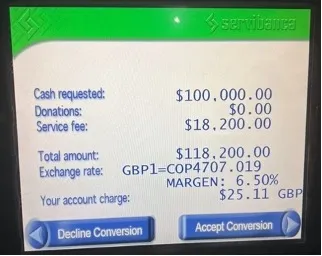

Let’s decode this. You have a UK bank card and money in British Pounds (GBP or £) in it. You go to the ATM in Colombia and say “I have money in my account in GBP. Can you give me Colombian Pesos (COP or C$) and take my British Pounds in exchange.” So now you have 2 options, use the currency exchange rate (i) Set by the ATM or (ii) Set by your own Bank. A foreign ATM often asks this by showing you a screen that says “Accept Conversion” or “Decline Conversion”. If you:

Accept Conversion: You exchange currency at the ATM’s set exchange rate. In our example, the ATM charges you an extra 6.5% DCC fee for the service.

Decline Conversion: You exchange currency your Bank’s set exchange rate. In our example, Bank charges 1.99% Forex mark-up for this service.

Which is better – Accept Conversion or Decline Conversion?

When it comes to ATM transactions abroad, in most cases, choosing “Decline Conversion” or “Without Conversion” and using your own card’s currency exchange rate is better. That’s because the ATM’s currency conversion fees on the currency exchange rate are almost always higher than your Bank’s exchange rates and associated fees. Of course, you should check your card’s fees for currency exchange (explained below) and take the decision of which fees are lesser and choose the option accordingly.

How can I save on foreign ATM related fees?

There are many ways to avoid the four types of foreign ATM fees when travelling abroad. Some of the ways of doing so are:

- Get a fee-free card from your Bank i.e. cards where your Bank does not charge any Foreign Transaction Fee or Forex-markup fee.

- Use a fee-free ATM i.e. ATMs which do not charge any ATM Access Fee. There are many banks in majority of the countries in the world that do not charge any ATM Access Fees. Use the ATM Fee Saver app to find such ATMs in 160+ countries. Download now from App Store or Play Store.

- Decline Conversion at a foreign ATM i.e. If a foreign ATM offers you the option to use the DCC facility, choose Decline Conversion to avoid the additional DCC charge.

We have an entirely dedicated article for you on this subject for you to read: Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

FAQs

I’m still confused, when does a foreign ATM charge ATM fees?

ATM fees for withdrawing cash abroad is the fee that an ATM in a foreign country can charge you when you use it for withdrawing cash as a “foreign” card holder. This means that your debit or credit card:

- Is issued by a bank or card company which is different from the ATM’s owner, and

- There is no specific tie-up between your bank or card company and the ATM’s owner to offer free ATM withdrawals to its customers.

- Is issued in a different country from the country of this ATM, and

Also read: Can I withdraw US dollars or euros abroad from an ATM?

The ATM owner, typically a bank or an ATM operator, will collect this ATM fee.

Do all ATMs abroad have fees and charges for foreign card holders?

When it comes to ATM fees abroad, the simple answer is that some foreign ATMs do not have ATM Fees and some charge at least some ATM Fees.

With regards to Currency Conversion Fees, most foreign ATMs offer the option of Currency Conversion Fees, it is up to the user to Accept or Decline conversion and bear the extra fees. Only a handful of ATMs in the world have this compulsory i.e. If you Decline Conversion, it will not give you any cash.

Do all banks and card companies charge fees to its own card holders to use the card abroad?

Again, the answer is no. There are many banks and card companies that offer cards without any fees to use the card abroad.

It takes a little bit of research to find out if there are such banks and card companies in your country. But it’s worth spending time to find the most cost-efficient card for international use. Read more on how you can do this here – Withdrawing cash abroad? 9 best ways to save foreign ATM fees.

Do all ATMs abroad have the same alert for an ATM Fee?

In different countries, ATM fees for foreign card holders have different names you might see on ATM screens – like ATM Usage Fee, ATM Transaction Fee, Foreign Access Fee, ATM Operator Fee, ATM Surcharge, Transaction Charge, Convenience fee, Cargo Adicional, Tarifa Adicional, etc. Don’t always expect ATMs to show you this in English or your native language. Keep a translator app ready for such cases.

When exactly do you pay this ATM Fee for the cash withdrawal abroad?

You will pay this ATM fee as soon as the foreign ATM machine has successfully given you the cash. E.g., You withdrew 2,000 as local cash and the ATM fee was 30. So your account balance goes down by a total of 2,030. In your bank statement, you may see this as one total amount or two separate amounts.

Do all ATMs abroad show fees for a cash withdrawal?

Generally, yes. If a foreign ATM has an ATM Fee, it will show it and ask if you still want to go ahead with the withdrawal. There are some ATMs in Turkey or Argentina that don’t inform you in advance. You can use ATM Fee Saver mobile app to find out the fees beforehand and choose the fee-free or lowest fee ATM that way.

Also read: Lose card abroad? Top 8 tips to get it back & save from misuse.

love your articles, the information is so useful. every traveller should read it. thanksssss

thanks dani, we are happy to help with all the information 🙂